Financial Planning

Financial Planning

As your investment partner, we are committed to helping you accomplish your unique financial goals and objectives. After developing a thorough understanding of your risk tolerance and short and long-term goals, we will work together to create a customized investment portfolio designed for you. In order to accomplish this, we will take you through the investment consulting process, which is designed to help us determine how to best address your financial goals and dreams.

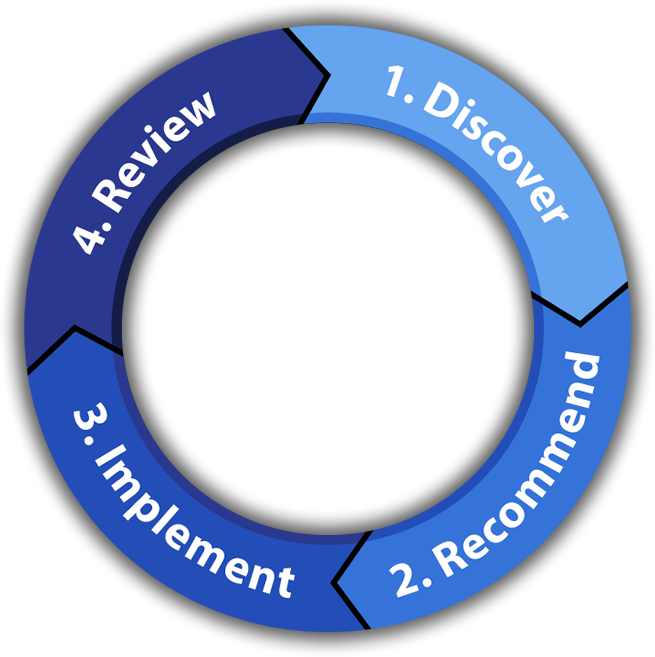

The planning process we engage in is not a once in a lifetime event. It is evolutionary, taking into account ongoing changes in your life, your resources and the financial decisions you need to consider. It is customized to your objectives, priorities and values. It is comprehensive and integrated, capable of addressing a wide range of financial circumstances and concerns. Our process progresses through four stages:

1. Discover

- What are your hopes and dreams?

- Do you have a high or low tolerance for risk?

- Do you have any specific tax considerations?

- What is your investment objective?

- What is your time horizon?

2. Recommend

- Investment portfolio recommendations

- Customized asset allocation strategies

- Wealth management services

- Diversification

3. Implement

- Account opening paperwork

- Funding

4. Review

- Quarterly performance reports

- Ongoing due diligence of investment managers

- Periodic reviews

- Investment newsletters

- Tax harvesting

- Portfolio rebalancing

WealthVision

WealthVision makes it easy to:

- Access real-time financial data 24/7

- View your Financial Goals & Plans

- Create up-to-date Balance Sheet & Net Worth Statements

- Monitor your Investment Strategy and progress toward your goals

- Access Estate planning, Life Insurance policies and related documents

- Aggregate All Accounts

- Share data & documents with trusted advisors such as CPAs and attorneys

- View Cash Flow & Retirement Models

- Access to all financial matters in a single, secure location

- Access financial data on-the-go using the all-new mobile app

@TomLandrysGhost if we somehow kick the FG, that SOB just drives down and scores a TD anyhow…seen it enough, to know the outcome. @weaverwealthnc

@TomLandrysGhost I have no problem with the call…no way I’m giving the ball back to Rodgers. Seen that story one t… https://t.co/mgbZzsJEjs @weaverwealthnc

Big tech had a big rebound (+8%) as a cooler CPI report trumped the mid-term elections and a meltdown in the crypto… https://t.co/rR26FdOXq8 @weaverwealthnc